Discounting Fees

Private practice dentistry has in the past been the most popular┬Āmodel for delivery of dental care in this country. For the most┬Āpart, the profession has fought against the insidious invasion by┬Āinsurance companies into dentistry, as we have all experienced┬Āin medicine.

Insurance companies have essentially skimmed the profits of our┬Āprofession for many years. Recently however, we have heard┬Āmore and more discussion by dentists, the ADA and consultants┬Āthat insurance participation may be the answer to declining┬Ārevenues. We need to look carefully at this answer. Insurance┬Ācompanies do not generate more profit for your office. On the┬Āsurface, it may appear that dental insurance generates more┬Āmoney for your practice. It may generate more gross income,┬Āmore patients and more work, but it takes the profits, not off the┬Ātop, but off the bottom line ŌĆō directly out of your pocket.

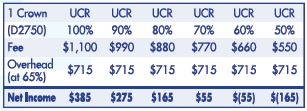

In the past, we have shown that a 20% discount off of UCR┬Āequals a 77% reduction in net income (if not more). In dollars,┬Āa porcelain/ceramic crown with a UCR of $1,100 reduced┬Āby 20% equals a payment of $880. With a 65% operating┬Āoverhead (which does not change because of your reduced fee)┬Āyour net income with the UCR fee is $385. With the reduced┬Āfee your net income is $165. Some will argue that $165 is┬Ābetter than nothing, and that is an individual practice decision.┬ĀThe insurance companies really donŌĆÖt discern whether the patient┬Āactually receives the care, and actually make more money if they┬Ānever show up in your office. In any event, they have actuarially┬Ācovered themselves knowing that they will never see 100% care┬Ārates and they usually have an annual payment cap anyway.

A History of Reduced Fees

LetŌĆÖs consider the history. Reduced fee insurance got aggressive┬Āin the 1970s and 80s when there was an over abundance of┬Ādental schools putting out an excess of dentists. Several things┬Āhappened. For the first time, dentists began to compete with one┬Āanother through advertising and insurance companies saw the┬Āopportunity to threaten dentistry with opening reduced fee clinics┬Āthroughout the country. They told you that since you had empty┬Āchair time available they would fill that with patients. ŌĆ£A dental┬Āclinic in every Sears storeŌĆØ was the threat.

The private practice model is definitely under attack. The threat┬Āwas perceived to be real because physicians, through their┬Āaffiliation with hospitals, were forced to accept the insurance if┬Āthey were to continue those affiliations. It was common to hear a┬Ādentist express concern that ŌĆ£If I donŌĆÖt join up, all my patients will┬Āflee to the clinics for cheaper care.ŌĆØ

The latest threat is coming from management companies or┬Ācorporate owners. Most will take any insurance plan just to get┬Āpatients in the door. WeŌĆÖve heard many reports from practices┬Āthat have provided 2nd opinions regarding treatment and all┬Āof them note that they are seeing an increase in over charging┬Āby unbundling services or by diagnosing unnecessary services.┬ĀWe do not know if this is a result of corporate ŌĆ£oversightŌĆØ and┬Āpressure to produce or driven by dentists who feel the need to┬Āaggressively treat since they will probably never establish real┬Ārelationships with the patients. There seems to be no monitoring┬Āby insurance companies though.

The Algorithm of Compensation Recovery

As we all know, there is no real dental insurance. Money is┬Āpaid to an insurance company that then negotiates fees for its┬Āsubscribers. The company then takes an administrative fee for┬Ānegotiating reduced fees. You as providers or your patients are┬Āthen left to fight for compensation for treatment that you provided.

Fortunately, dentistry was, and is, an entrepreneurial profession.┬ĀFor the most part, dentists resisted enough to stem the tide. Some┬Ācaved in and learned how to ŌĆ£work the systemŌĆØ while others┬Ājust slogged along and never achieved the dream they set out┬Āto achieve. A great many held firm and stood their ground,┬Āproviding quality fee for service dentistry by building strong┬Āpatient relationships and rendering excellent patient care.

Stand Your Professional Ground

Recently in California and Washington State, Delta Dental┬Āwithheld payments to dentists in the Premier program┬Āunless they agreed to the reduced fees of the regular Delta┬Āinsurance program. This is one more strong arm maneuver aimed at┬Ābreaking the back of the hold-outs. The insurance┬Ācompanies know that the economy is rough and that dentistŌĆÖs gross┬Āproduction is down, so once again they are pressuring the┬Āprofession to accept that reduced fee dentistry is here to stay.

In looking at the landscape of the existing advice, it is very┬Ādisappointing that some of our colleagues in dental practice┬Āmanagement and consulting are suggesting that ultimately┬Āreduced fee dentistry is a given, and we might as well accept┬Āit. We suggest that they are, in fact, doing a disservice to the┬Ādental profession. Patients still seek out personal care and are┬Āwilling to pay for it. Service, hospitality and quality of care DO┬Āmatter. Stay the course and dentistry

Share