When Insurance is Unsure: Stay Focused on Patient Care

Private practice dentistry has in the past been the most popular┬Āmodel for delivery of dental care in this country. For the most part,┬Āthe profession has fought against the insidious invasion by insurance┬Ācompanies into dentistry, as we have all experienced in medicine.

Insurance companies have essentially skimmed the profits of our┬Āprofession for many years. Recently however, we have heard more and┬Āmore discussion by dentists, the ADA and consultants that insurance┬Āparticipation may be the answer to declining revenues. We need to┬Ālook carefully at this answer. Insurance companies do not generate┬Āmore profit for your office. On the surface, it may appear that dental┬Āinsurance generates more money for your practice. It may generate┬Āmore gross income, more patients and more work, but it takes the┬Āprofits, not off the top, but off the bottom line ŌĆō directly out of your┬Āpocket.

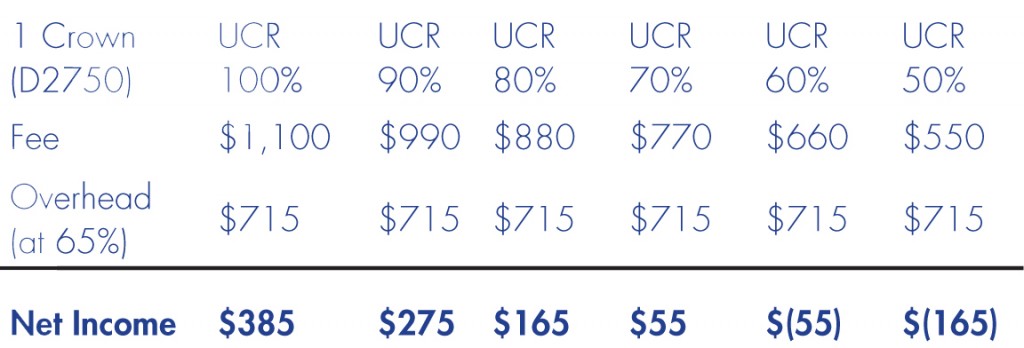

In the past, we have shown that a 20% discount off of UCR equals┬Āa 77% reduction in net income (if not more). In dollars, a porcelain/ceramic crown with a UCR of $1,100 reduced by 20% equals a┬Āpayment of $880. With a 65% operating overhead (which does not┬Āchange because of your reduced fee) your net income with the UCR┬Āfee is $385. With the reduced fee your net income is $165. Some┬Āwill argue that $165 is better than nothing, and that is an individual┬Āpractice decision. The insurance companies really donŌĆÖt discern┬Āwhether the patient actually receives the care, and actually make more┬Āmoney if they never show up in your office. In any event, they have┬Āactuarially covered themselves knowing that they will never see 100%┬Ācare rates and they usually have an annual payment cap anyway.

┬Ā

A History of Reduced Fees

LetŌĆÖs consider the history. Reduced fee insurance got aggressive in┬Āthe 1970s and 80s when there was an over abundance of dental┬Āschools, putting out an excess of dentists. Several things happened.┬ĀFor the first time, dentists began to compete with one another through┬Āadvertising and insurance companies saw the opportunity to threaten┬Ādentistry with opening reduced fee clinics throughout the country.┬ĀThey told you that since you had empty chair time available they┬Āwould fill that with patients. ŌĆ£A dental clinic in every Sears storeŌĆØ┬Āwas the threat.

The private practice model is definitely under attack. The threat was┬Āperceived to be real because physicians, through their affiliation with┬Āhospitals, were forced to accept the insurance if they were to continue┬Āthose affiliations. It was common to hear a dentist express concern that┬ĀŌĆ£If I donŌĆÖt join up, all my patients will flee to the clinics for cheaper care.ŌĆØ

The latest threat is coming from management companies or corporate┬Āowners. Most will take any insurance plan just to get patients in the┬Ādoor. WeŌĆÖve heard many reports from practices that have provided┬Ā2nd opinions regarding treatment and all of them note that they are┬Āseeing an increase in over charging by unbundling services or by┬Ādiagnosing unnecessary services. We do not know if this is a result┬Āof corporate ŌĆ£oversightŌĆØ and pressure to produce or driven by dentists┬Āwho feel the need to aggressively treat since they will probably never┬Āestablish real relationships with the patients. There seems to be no┬Āmonitoring by insurance companies though.

The Algorithm of Compensation Recovery

As we all know, there is no real dental insurance. Money is paid to┬Āan insurance company that then negotiates fees for its subscribers. The┬Ācompany then takes an administrative fee for negotiating reduced fees.┬ĀYou as providers or your patients are then left to fight for compensation┬Āfor treatment that you provided.

Fortunately, dentistry was, and is, an entrepreneurial profession. For┬Āthe most part, dentists resisted enough to stem the tide. Some caved┬Āin and learned how to ŌĆ£work the systemŌĆØ while others just slogged┬Āalong and never achieved the dream they set out to achieve. A great┬Āmany held firm and stood their ground, providing quality fee for┬Āservice dentistry by building strong patient relationships and rendering┬Āexcellent patient care.

Stand Your Professional Ground

Recently in California and Washington State, Delta Dental withheld┬Āpayments to dentists in the Premier program unless they agreed to the┬Āreduced fees of the regular Delta insurance program. This is one more┬Āstrong arm maneuver aimed at breaking the back of the hold-outs.┬ĀThe insurance companies know that the economy is rough and that┬ĀdentistŌĆÖs gross production is down, so once again they are pressuring┬Āthe profession to accept that reduced fee dentistry is here to stay.

In looking at the landscape of the existing advice, it is very disappointing┬Āthat some of our colleagues in dental practice management and┬Āconsulting are suggesting that ultimately reduced fee dentistry is a┬Āgiven, and we might as well accept it. We suggest that they are, in┬Āfact, doing a disservice to the dental profession. Patients still seek out┬Āpersonal care and are willing to pay for it. Service, hospitality and┬Āquality of care DO matter. Stay the course and dentistry will not suffer┬Āthe demise that we have all seen in medicine.

Share